Happy New Financial Year!

Let’s start this new financial year the way we want to finish it: organised, prepared and in control.

Let’s do some proper number crunching and create a budget. When we have a plan and are accountable to ourselves, we are more likely to stay in control of our expenditures.

Talking about money can often overwhelm people. It can be easier to just go week to week. Sitting down and really becoming intimate with your expenditure and income can be frightening. Financial conversations were not always addressed when we were growing up, with many of us having to learn from our mistakes. This is often the best way to learn, but it can also cost us a lot! Why would we do that, when we can have a few simple action steps in place to get us started on the road to profitability?

Now, full disclosure here, I am not a financial expert! I am just a lady who has run her own business for nearly 10 years now. Both FDC and a service. I have made MANY mistakes, and also learnt many valuable lessons, some of which I will share today!

What we saw during the COVID-19 situation was many people not being prepared for disruption in their business. We now know just how quickly that can happen. Having a budget and a plan can alleviate stress when things go a bit pear-shaped. It can also give you a renewed sense of purpose and control.

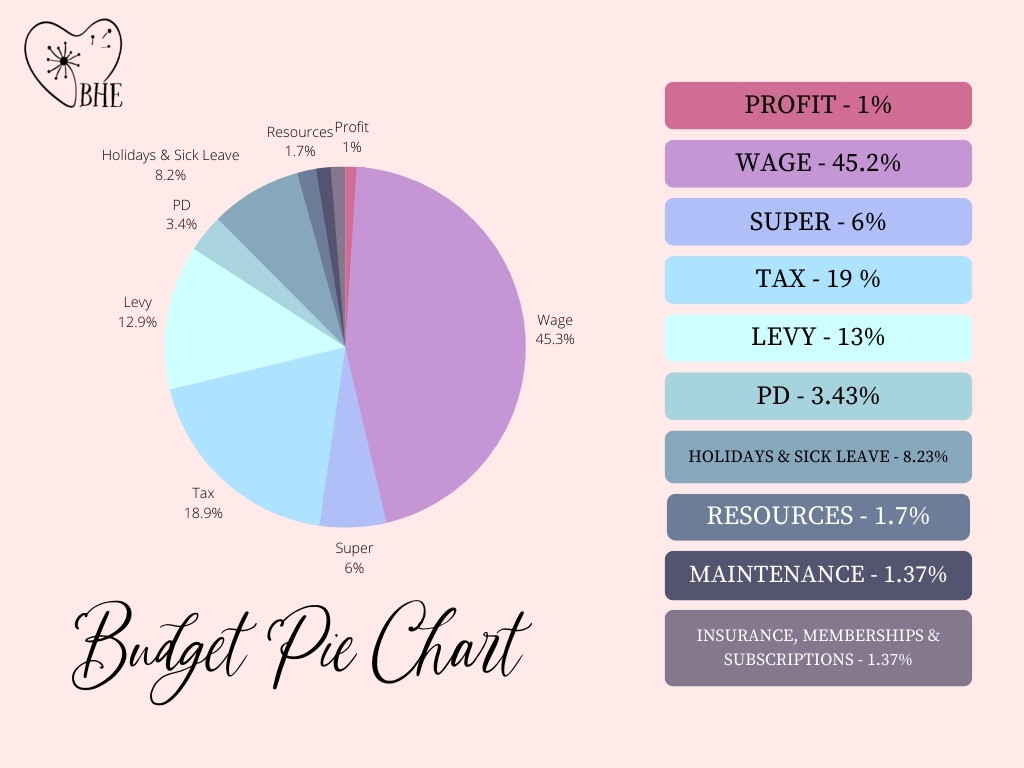

I like to divide my budget up into the good ole pie. It helps me to see easily where the bulk of my funds need to go. Now obviously every person is going to have different circumstances, so this template is one you can apply to your own needs.

I set my category percentages up first. When I was doing FDC, mine was set up like this:

Profit 1%

Wage 45.5%

Super 6%

Tax 19%

Levy 13%

PD 3.43%

Holidays and sick leave 8.23%

Resources 1.7%

Maintenance 1.37%

Insurance, Memberships, Subscriptions 1.37%

When you see it in the pie shape, it takes on a different meaning.

You can use our handy pre-made Canva template here (you will need to have a Canva account to make a copy to edit with your own details. If you need to sign up, simply follow the prompts to register for a free account when you click the link).

To work out the percentage, you can use this calculator: https://www.calculatorsoup.com/calculators/math/percentage.php

Now, most people will not look to putting profit first, however, if you do not plan to make your business profitable, you are planning to end up being a slave to your job. No one goes into business just to live week to week.

You have to have difficult conversations with yourself to really know which levers to pull in your business. I look at each slice of the pie as a lever. Each one gives you flexibility. You can trim from one, to bulk out another. But once you have your slices in order you will also be creating a plan!

Now, your profit first slice must ALWAYS be paid first. I recommend that you start with just 1% this season. As you get better and more disciplined you can start to put more aside. Getting up to 5% profit is not out of the question. Over 12 weeks that will add up to quite the quarterly bonus. This profit is then to be paid to you to do whatever you want with! It is your bonus. If we continually work with no reward, we will have no incentive to do better!!

Starting with just 1% will allow you to grow this percentage. You will get the bug to reduce costs elsewhere.

It is important to note that cutting costs is also a balancing act. Being in early childhood education, and needing to meet the requirement of adequate resources for the children in care means that we cannot scrimp there. I am not suggesting that you spend thousands every season on resources, more that you become mindful about what, and how much you spend.

Setting a resource budget, and sticking to it suddenly becomes imperative! It also allows you to work your tax to best suit your needs. You can allocate more funds to be spent if you need to reduce your income or spend less if you need to increase it.

You cannot do any of that if you don’t know your numbers intimately.

You can also set your percentages to align with your values too. You might decide to do a course one season, then no learning for the next. That will allow you to reallocate your PD budget elsewhere. As you can see, there is lots of room to move here. Looking at your number like this will also give you an incentive to charge your worth... but that is another topic for another day!

Over to you, what did you get out of this topic?